There is no change in our comments from two days ago. Markets want to go lower after early morning rallies which last till 8:30 AM West coast time because of foreign buying.

SPY

DJI

DJT

NYA

IWM

TNA

GLD

NUGT

DUST

ERX

ERY

UVXY

We take the liberty of publishing a portion of this article from www. KingworldNews.com

"The Greatest Fairy Tale Is Becoming A Nightmare That Will End In Total Collapse"

"The Bear Stearns Of The Muncipal Debt Crisis In The United States

But before investors mistakenly press the buy button once again, they have to realize that Puerto Rico is simply emblematic of a much larger problem. Puerto Rico is not an anomaly, it is more likely to be the “Bear Sterns” of the inevitable municipal debt crisis in the United States.

And then we have Greece. One thing is clear: Greece will default either through restructuring or debt monetization. The Greeks can remain in the European Union and submit to the austerity dictated to them by their German masters; or they can opt for self-imposed fiscal and monetary disciple under their own currency. In either case, this is a nation with a debt-to-GDP ratio north of 170% and which suffers from sharply contracting revenue growth. Chaos and default in Greece are unavoidable; but is best dealt with on their own terms.

China, Japan, Europe And The United States May Be Next

And as the rest of the world gawks at Greece and Puerto Rico’s economic misfortunes, what they fail to realize is that China, Japan, Europe and the United States aren’t that much different.

First let’s take Japan, one of the top economies in the world, whose debt is quickly approaching 250% of its GDP. If there was any question if Prime Minister Shinzo Abe’s three kamikaze arrows would be successful at saving the flailing Japanese economy, this week’s industrial output should provide the clear answer.

Japan’s Industrial output fell in May at the fastest pace in three months, the 2.2 percent decline in output compared with the median estimate for a 0.8 percent drop. This added to fears the economy may once again be in contraction mode in the current quarter. The irony is that one of Abe’s arrows sought to destroy the Japanese yen in order to spur exports and economic growth. But Japanese GDP is lower today than it was back in 2010.

The United States is not much better. After seven years of zero interest rates and unprecedented debt monetization, our national debt load ($18.3 trillion) stands at 103% of our phony GDP. In the first quarter of 2015 the US economy contracted by 0.2% and growth is predicted to be around just 2% in Q2 — making growth at or below 1% for the entire first half. The additional $8 trillion in publicly traded debt piled onto the nation following 2007 was supposed to lead to economic nirvana, not a perpetual economic stupor.

And then of course we have China, whose market, despite massive government and central bank manipulation, has officially entered into bear-market territory. Even with recent losses, the Shanghai Composite has surged 25% this year, and the Shenzhen Composite is up 67%. This stock market boom runs contradictory to the slowing pace of growth, which is at its weakest pace since 2009, while corporate profits are actually lower than they were a year ago.

This means exuberance for Chinese stocks isn't backed up by fundamentals. Instead, it appears markets are being levitated by continued government borrowings and manipulations–both of which seem to have lost their magic over the past few weeks.

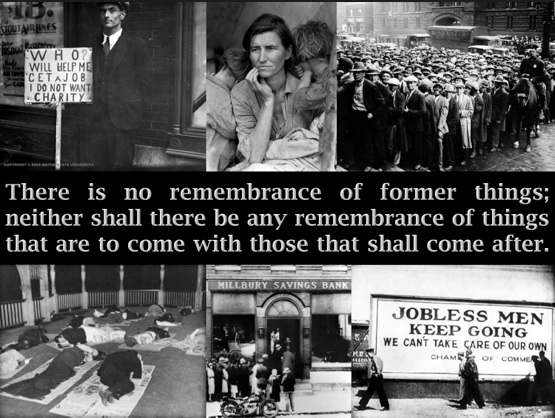

The Greatest Fairy Tale Is Becoming A Nightmare

But the greatest bubble of all is the fairy tale that central bank money printing can lead to prosperity. The credibility of central banks to push asset prices and GDP inexorably higher through endless debt monetization is fading fast. The ugly truth is that debt in the developed world has now grown to such an excess that it has to be restructured or monetized.

This is why there isn’t an honest bond market left in the world. It is why the Bank of Japan is buying every Japanese government bond issued. And why the People’s Bank of China keeps cutting lending rates and reserve ratio requirements to prop up its ailing economy and bubble-addicted stock market. It’s also why the European Central Bank pledged “to do whatever it takes” to keep sovereign bond yields from rising—even in Greece. It is also the sad truth behind why the Fed seems unwilling to raise interest rates higher than zero percent…even after seven years.

Total Collapse And A Worldwide Depression

These central banks are aware that once interest rates rise the whole illusion of solvency vanishes and the entire developed world will look no different than Greece and Puerto Rico. Once interest rates normalize, which is inevitable, these nations will undergo an explosion in debt service costs just as their bubble economies implode, causing annual deficits to skyrocket out of control. Therefore, unfortunately, a worldwide deflationary depression and/or intractable inflation has now become our unavoidable fate."